How Is A Chapter 13 Plan Calculation Performed?

A Chapter 13 plan calculation is based on two premises: your budget (ability to pay), and your mandatory repayments.

The Chapter 13 Budget

One premise behind Chapter 13 is that you must pay all disposable income to your creditors. This is known as your ability to pay. As such, you must show the court your ability to pay in the paperwork you file. You and your bankruptcy attorney will propose a budget to the court. The budget will be laid out in your filing as Schedule I (Income) and Schedule J (Expenses). Any ‘left over’ money in your budget must be committed to your unsecured creditors each month as Net Disposable Income.

When calculating the budget, your mortgage and vehicle payment are accounted for, together with all other ordinary and ongoing income and expenses. While the budget is not exact, you must use good faith efforts to disclose your anticipated ongoing income and expenses. The items you do not put into your budget are the ongoing debt payments to creditors—those are being removed as part of the relief offered by Chapter 13. Again, your Net Disposable Income (Sample of Net Disposable Income form) will be assigned to those creditors each month. If your plan is approve, they are required to accept those amounts as payment.

Chapter 13 Budget Example

A very simplified Chapter 13 budget example would be as follows:

Gross Monthly Income – $4,000.00

Monthly Expenses – $3,890 (Taxes $900, Mortgage $1,600, Vehicle $340, Food $600, Utilities $375, Home Maintenance $150, HOA $150, Hobbies/Entertainment $150, Health Insurance $450, Misc. $75)

Net Disposable Income – $110

In the example above, your Net Disposable Income (Income minus Expenses) is $110. You would need to commit $110 per month to your Chapter 13 creditors as part of your Chapter 13 plan calculation.

Mandatory Chapter 13 Payments

While your budget shows your ability to pay creditors, there are also mandatory payments which must be considered when calculating your Chapter 13 payment. In the example above, the debtor is keeping their home and vehicle. Both of those items have payments. As such, those payments are built into the calculation.

Suppose the debtor also owed the IRS $2,000. If that debt is from taxes which are less than 3 years old at the time of filing, that is a mandatory payment which must be paid in full over the life of the plan. When divided over a 60 month plan, the $2,000 debt comes to roughly $33 per month. As such, the $110 does not change for the debtor; however, $33 of that $110 each month will go to the IRS. This is an example of how the ability to pay works in tandem with mandatory payments.

Other examples of mandatory payments include: attorney fees, filing fees, mortgage arrears, vehicle arrears, child support, state taxes owed.

What If Mandatory Payments Exceed Net Disposable Income?

If your budget is very tight and you have a large mandatory payment which must be paid in full during your plan, you must show the court that despite the calculations, your plan is still feasible. Taking the example above, if the debtor owed the IRS $10,000, this would amount to a $166/month payment to the IRS; however, the debtor already established they only have $110 available for Chapter 13. Without further explanation, the trustee would object to the proposed plan because it is not ‘feasible’ given the debtor’s current budget.

One way to overcome feasibility objections in a Chapter 13 plan calculation is to provide an explanation to the court in your filing, showing the court why you believe you will be able to make the payments. It could be that you have a family member who has told you they will help out. Or, perhaps you expect your income to increase slightly in the near future. Perhaps a certain monthly expense is about to be removed from your budget. Any one or all of those things will start a conversation with the trustee about the feasibility of your plan.

Our experience has been that the easiest way to overcome a feasibility objection is to make your payments on time. In other words, when your attorney files your Chapter 13 case, you should make a full payment as quickly as possible. This way, when you attend your 341 hearing, the court will see that you’ve already demonstrated your ability to pay by making a payment on time. This, together with an explanation as to why you think ongoing payments are feasible, will most likely appease the court.

Additional Items Making Up The Chapter 13 Payment

If you still owe your attorney fees, those will be treated as a mandatory fee and will be calculated as the IRS payment was calculated above. Additionally, the trustee’s office charges a 4% fee for every dollar that flows through the plan. Therefore, if your mortgage is $1,000 and you have a budget of $100 Net Disposable Income, you will have a trustee fee of $44 added to the payment. Your bankruptcy attorney will account for this in the calculations—it will not be an additional fee.

If you own property, you must determine the equity in the property. The bankruptcy court allows you to keep a certain amount of equity in property, and these allowances are known as Exemptions. If your equity exceeds the allowable exemptions, you must propose a plan which pays at least that excess amount to the unsecured creditors, over the course of the plan. Your bankruptcy attorney will make sure your plan meets this test.

Gaining Perspective Regarding Your Chapter 13 Payment

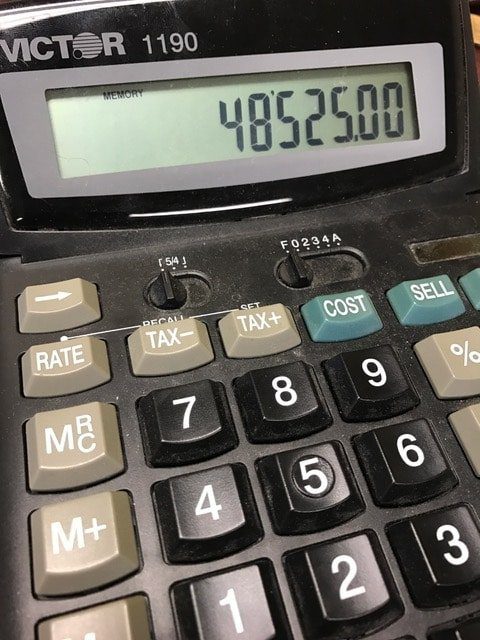

Keep in mind, you may be discouraged about paying a trustee fee, or committing $100 a month to unsecured creditors; however, when you look at the full picture, Chapter 13 typically offers debtors a very enticing deal. In exchange for paying a very small payment to unsecured creditors each month, the remainder of the debt will be discharged. In the example above, if the debtor has $50,000 of unsecured debt, the Chapter 13 plan will allow them to receive a discharge of that debt in exchange for roughly $6,300 spread out over 60 months.

Speak With A Charlotte Bankruptcy Attorney Today

If you have not already, speak with a Charlotte bankruptcy attorney today. We can be reached at 704.749.7747 and we’re happy to help you understand the options. You can also request a FREE CONSULTATION and we will be in touch soon.