How Much Debt Do You Need To File Bankruptcy?

There is no set amount of debt needed to file bankruptcy. In deciding whether to file bankruptcy, we examine the amount of debt you have, the type of debt you have, and whether you qualify for Chapter 7 or Chapter 13 from an income perspective. This article seeks to address concerns surrounding “How much debt do you need to file bankruptcy?”.

Unsecured Debt

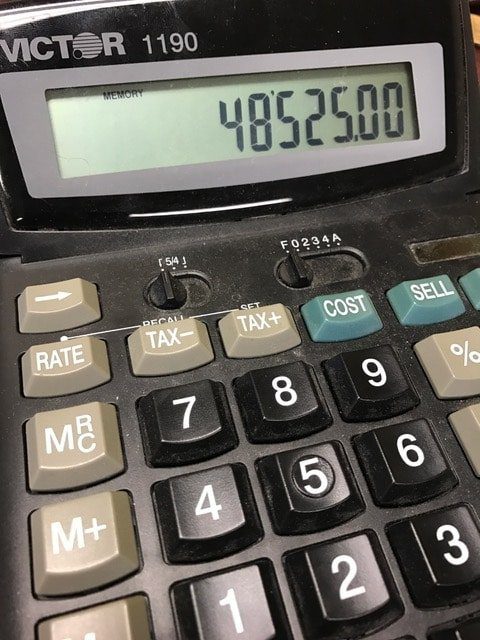

Unsecured debt is a debt that is not tied to any property. Common examples include credit card debt and credit “lines”. Unsecured debt is discharged in bankruptcy. When deciding if you have enough debt to file bankruptcy, you might consider the cost of filing bankruptcy as compared to what it would cost you to settle the debts with each creditor. Our office routinely assists clients with debt settlement when it makes more sense to settle the debt instead of file bankruptcy. Generally speaking, if you have more than $15,000.00 of unsecured debt and you do not have the ability to settle that debt or keep current on payments, you should consider a bankruptcy filing.

Secured Debt

Secured debt is a debt that is “secured” by a property—a car or home, typically. In a bankruptcy filing, you have the choice to either keep the secured debt (See: Keep Your Car In Bankruptcy) or discharge the debt. Keep in mind, the property travels with the debt. If you choose to keep the property, you keep the debt. If you surrender the property, the debt goes with it.

Upside Down Vehicles

Many clients are faced with a vehicle that is upside down. In other words, prior to bankruptcy, the value of the car is worth less than the loan balance. Trading the car in for a new car simply means carrying that negative equity into the new vehicle purchase. Bankruptcy offers a different solution. You can purchase a new car just prior to filing bankruptcy. Then, when you file the bankruptcy, you surrender the old car (and the old debt), and you are left with only the new car and the new car debt.

Creative Bankruptcy Solutions

You will find that much like the vehicle solution above; bankruptcy offers an opportunity to deal with your debt creatively. Chapter 13, which we discuss in greater detail in prior blog posts, also offers vehicle and home solutions ranging from stopping foreclosure to lowering your vehicle interest rate. Often, these solutions more than make up for the cost of filing bankruptcy.

Speak With A Bankruptcy Lawyer Today

If you have questions about “How much debt do you need to file bankruptcy?”, we are here to help. Call us at 704.749.7747 or click HERE to request a free consultation. You deserve to understand your options and we would love to speak with you.